Another Short Covering Session Will Expect for the Day...

- Millennial Investor's Service

- Oct 21, 2024

- 2 min read

EQUITY BULLETIN FOR 21 OCTOBER 2024

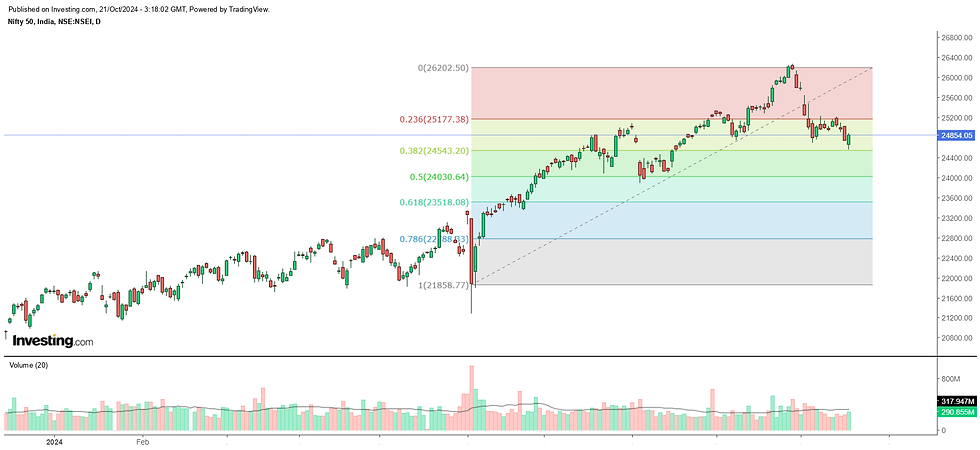

The bulls regained control of the market on October 18, reversing a three-day losing streak after the Nifty 50 briefly dipped near the 20-week Exponential Moving Average (EMA) of 24,550. The index rallied by 104 points, closing just above 24,850.

The Nifty Put-Call Ratio (PCR), a key sentiment indicator, rose to 0.93 from 0.88 in the previous session, signaling a shift in market mood. Volatility, despite an intraday spike above 14, eased and ended a three-day uptrend, creating a more favorable environment for bulls. The India VIX dropped 2.61 percent to 13.04 from 13.39 levels, further supporting positive sentiment.

Nifty Future Overview

Nifty Futures experienced a sharp recovery from the week's low in the last trading session, ultimately closed on a reversal note. We anticipate more short covering in the upcoming session.

Currently, Nifty has key support around 24750 and resistance near 25000. A break and a sustained move above 25000 could drive Nifty towards 25100-25150 levels.

On the downside, if Nifty breaks below 24750, we could see a decline toward 24650. A "buy on dips" strategy near support levels may benefit traders.

Trading Strategy for Nifty Futures

Traders are advised to Buy Nifty Futures above 25000, with a stop loss set below 24850 for potential targets up to 25150—25200 levels.

Bank Nifty Overview

Bank Nifty reversed sharply and formed a bullish engulfing reversal pattern on the lower levels in the last session. Now Bank Nifty has major support at 51900 and resistance at 52450. Sustained movement above 52450 could push Bank Nifty towards 52700-53000.

Conversely, a break below 51900 could trigger a correction towards 51700-51500. A "Buy on Dips" strategy around the support zone is recommended for traders.

Trading Strategy

Buy Bank Nifty Future on dip around 52000 with a stop loss below 51700 for the upside movement till 52300—52600 levels in an intraday trading session.

In conclusion, traders are advised to remain vigilant amidst market fluctuations and capitalize on strategic entry and exit points to optimize their trading endeavors.

Stock Pick of the Day

SBIN (21/10/2024)

Buy SBIN Futures around 820 for the upside move till 840 and then to 850 levels in the coming days. Stop loss below 800.

Stay tuned for further insights and updates from Millennial Investor Services - Your Trusted Stock Market Advisory Partner.

Comments